FTSE 100 FINISH LINE 30/1/26

FTSE 100 FINISH LINE 30/1/26

Heavyweight banking stocks initially boosted London's FTSE 100 on Friday, setting the index on course for a seventh consecutive month of gains, as investors evaluated the appointment of Kevin Warsh as the new U.S. Federal Reserve chair. However, the blue-chip index pared gains and hovered near the flatline as trading for the week neared its close. The FTSE remains poised for its longest monthly winning streak in over 12 years and is also set to achieve weekly gains following losses in the prior week. Meanwhile, the domestically focused FTSE 250 remained flat on Friday but is on track to end both the week and month in positive territory. Geopolitical tensions resurfaced as Donald Trump warned the UK against deepening business ties with Beijing, labeling it "dangerous." In contrast, Prime Minister Keir Starmer highlighted the potential economic benefits of strengthening the UK-China relationship during his visit to China on Friday. On the economic front, British business confidence dipped in January, coinciding with global economic optimism hitting a one-year low. Despite this, a Lloyds survey indicated that businesses remained optimistic about their own performance and hiring plans, even amid broader uncertainty.

Precious metals miners dropped 4.4% as gold prices plunged over 4%, driven by speculation of a more hawkish Federal Reserve chair. Despite this daily decline, the sub-index has gained approximately 20% this month. Industrial metal miners also fell, closing 2.5% lower. Conversely, the banking sub-index climbed 3.5% for the week and about 5.3% for the month, with a 1.2% gain on Friday. Notable performers included Lloyds and Investec, which rose 2% and 1.4%, respectively. Shares of Experian surged 2% to 2,749p, making it the top gainer on the FTSE 100 index, following the announcement of a $1 billion share repurchase program. The company reaffirmed that its medium-term financial framework, capital allocation, and dividend policy remain unchanged. However, Experian’s stock had experienced a ~2% decline in 2025..

TECHNICAL & TRADE VIEW - FTSE100

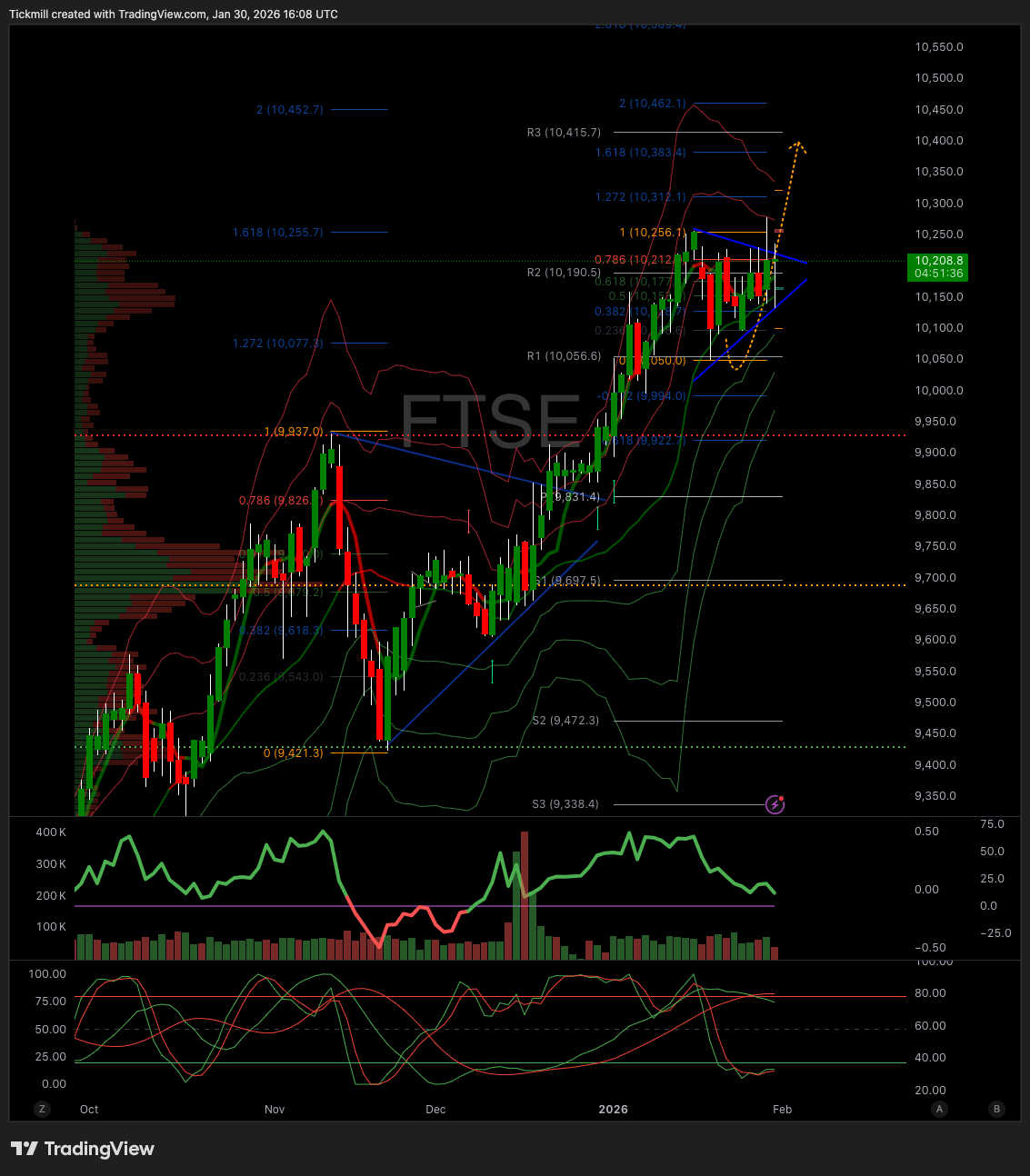

Daily VWAP Bullish

Weekly VWAP Bullish

Above 10150 Target 10300

Below 10070 Target 9950

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!